SaaS is Dying and AI is the Bullet

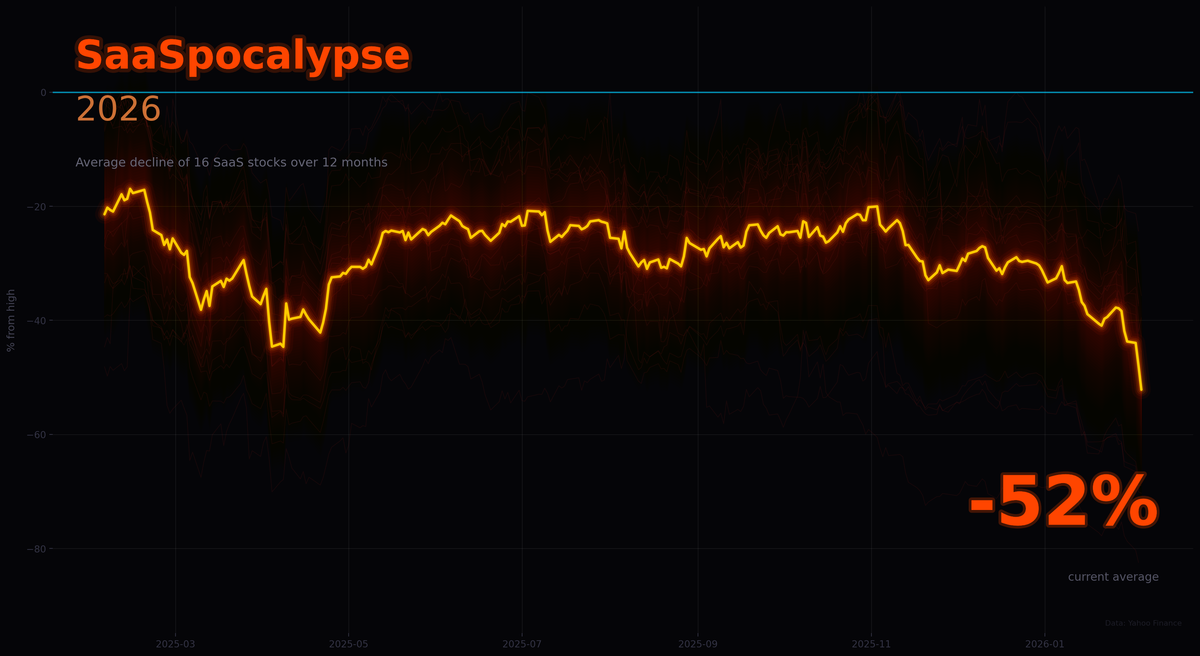

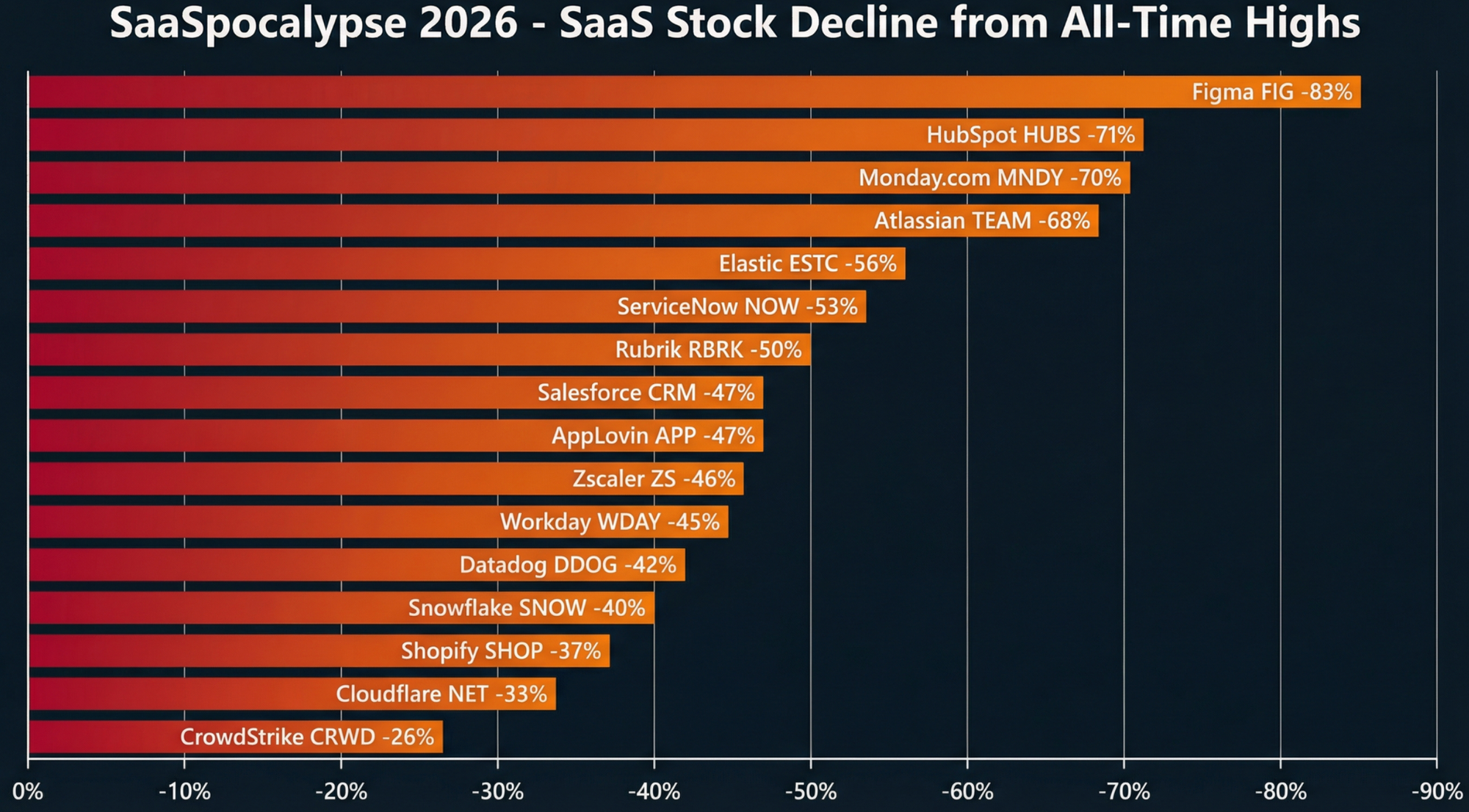

TL;DR: SaaS worked because building custom software was expensive ($500K+, 18 months). AI broke that math—companies can now build 100% customized solutions in weeks for a fraction of the cost, with ROI in months, sometimes weeks. The market has noticed: Figma -83%, HubSpot -71%, Salesforce -47%. This isn’t a correction—it’s the market pricing in the end of “building software is hard” as a business moat.

Look at this chart (data from the outstanding @stocksavvyshay):

This isn’t a correction. This is a mass extinction event.

The Math Has Changed

For the last fifteen years, the SaaS pitch was simple: pay us monthly, we’ll handle the infrastructure, you get updates automatically, and you’ll never have to build this yourself.

That last part was the key. Building custom software was expensive. You needed developers, designers, project managers, DevOps engineers. A simple CRM would cost $500K and take 18 months. Better to pay Salesforce $150/user/month and be done with it.

AI broke that math.

What used to cost $500K and 18 months can now be built in weeks for tens of thousands. Sometimes less. And the result isn’t a generic tool that sort of fits your needs—it’s exactly what you want, built around your specific workflows, integrating with your specific systems.

The ROI calculation has flipped.

I've been a enormous SaaS proponent for much of the last 20 years. Most companies don't have the engineering or security staff to do software themselves. But the vendors got greedy. It all got too expensive and too complex.

Then AI struck.

Now the death knell is playing.

The New Equation

Here’s what companies are discovering:

Old math: $150/user/month × 500 users × 12 months = $900,000/year for Salesforce

New math: $50,000 one-time cost for an AI-built custom CRM that does exactly what you need, integrates with everything you use, and costs maybe $5,000/year to run.

Payback period? Two months.

And that custom system doesn’t force you into someone else’s workflow. It doesn’t have 400 features you’ll never use while missing the three you actually need. It doesn’t charge you extra for API access to your own data.

This isn’t theoretical. The fast-moving companies are doing this right now.

Why SaaS Companies Can’t Adapt

The SaaS model has a structural problem: it’s built on the prices that assume building software is hard.

Every SaaS company has:

- Massive engineering teams maintaining generic platforms

- Sales teams that cost more than the product

- Customer success teams managing churn

- Infrastructure scaled for millions of users

When your customer can build a custom version of your product in weeks, none of that scales. Your cost structure becomes a liability.

Salesforce can’t suddenly become cheap. HubSpot can’t suddenly become simple. Workday can’t suddenly become flexible. Their entire business model is predicated on complexity that justifies the price.

AI makes that complexity unnecessary.

The Timeline

I’m not saying Salesforce goes to zero next year. These companies have contracts, switching costs, and enterprise inertia on their side.

But look at the chart again. The market is pricing in a future where:

- New companies don’t adopt SaaS—they build custom from day one

- Existing customers slowly migrate off as contracts expire

- The growth engine that justified these valuations grinds to a halt

Some SaaS categories will be hit harder than others:

Most vulnerable: CRMs, project management, marketing automation, basic analytics. These are exactly the kind of “boring CRUD apps” that AI builds best.

Somewhat protected: Deep infrastructure plays, security, highly regulated industries. Though even these are seeing AI eat at the edges.

Actually growing: AI-native tools that help you build the custom stuff. The picks and shovels.

What Comes Next

The winners in this transition aren’t SaaS companies that “add AI features.” That’s like a horse-drawn carriage company adding a motor—you’re still fundamentally selling carriages.

The winners are:

- AI development platforms that make building custom software trivially easy

- Integration layers that let custom apps talk to everything

- Companies that help enterprises make this transition without burning down their operations

And ironically, the biggest winner might be in-house development teams. After a decade of “just use SaaS,” companies are rediscovering that owning your tools means owning your destiny.

The Investment Thesis

If you’re holding SaaS stocks hoping for a rebound, ask yourself: what’s the bull case?

- “AI will make their products better” — But AI makes competitors’ products free

- “Enterprise contracts are sticky” — For now. But CFOs are looking at that chart too

- “They’ll acquire AI companies” — With what multiple?

The chart isn’t lying. The market has figured out that the SaaS moat—”building software is hard”—has been drained.

The Opportunity

Every crisis is an opportunity for someone.

- If you’re an enterprise drowning in SaaS costs, this is your moment. Start identifying which tools could be replaced with custom-built alternatives. Run the math. Pick one and try it.

- If you’re a developer, the market for “help companies escape SaaS” is about to explode. Learn the AI-assisted development stack. Position yourself as the person who saves companies $500K/year in SaaS fees.

- If you’re a SaaS company… I don’t know what to tell you. The honest answer is that the business model that made you successful is becoming obsolete. You can pivot, acquire, or manage decline. There’s no path where everything stays the same.

SaaSPocalypse 2026

That chart at the top? That’s not the end. That’s the market starting to price in a fundamental shift in how software gets built and sold.

SaaS was a great model when building software was hard.

AI made building software easy.

The first AI bullets already hit SaaS hard. More are in flight.